Alternatives Gain Traction Among DC Plan Advisors Following Federal Policy Shift

New research from Escalent shows one quarter of DC advisors likely to recommend alternatives, with National, large-scale producers driving the trend

LIVONIA, Mich., Dec. 15, 2025 (GLOBE NEWSWIRE) -- One in four defined contribution (DC) plan advisors now say they are likely to recommend alternative investments within DC lineups, with another 10% reporting they are already doing so. The growing emphasis on alternative investments comes after the US Department of Labor (DOL)’s August 2025 decision to reverse its previous stance on the suitability of alternatives within 401(k) and other workplace DC plans.

National advisors and those with $50 million or more in assets under management (AUM) demonstrate the strongest appetite for the asset class. Nearly half (44%) of national advisors and over one-third (35%) of advisors managing $50M+ in AUM reported that they are either already recommending alternatives or are extremely likely to do so in the future.

These are the latest findings from the 2025 Retirement Plan Advisor Trends™, a Cogent Syndicated report from Escalent. The study is designed to help retirement plan providers and DC investment managers better understand the perspectives and preferences of financial advisors who sell and support employer-sponsored retirement plans (ESRPs).

“We know from previous research that interest in alternative investments has been rising on the retail side,” said Linda York, a senior vice president in Escalent’s Cogent Syndicated division. “These findings show that the same enthusiasm is starting to take hold within the DC plan space. Advisors have traditionally turned to alternatives as a diversification lever for high-net-worth and institutional clients. Now, these options are becoming more relevant for employees across all income levels. The fact that so many advisors are advocating for the inclusion of alternatives within DC plans indicates just how quickly the market is changing.”

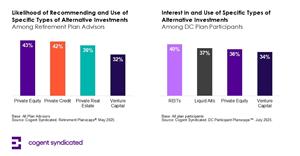

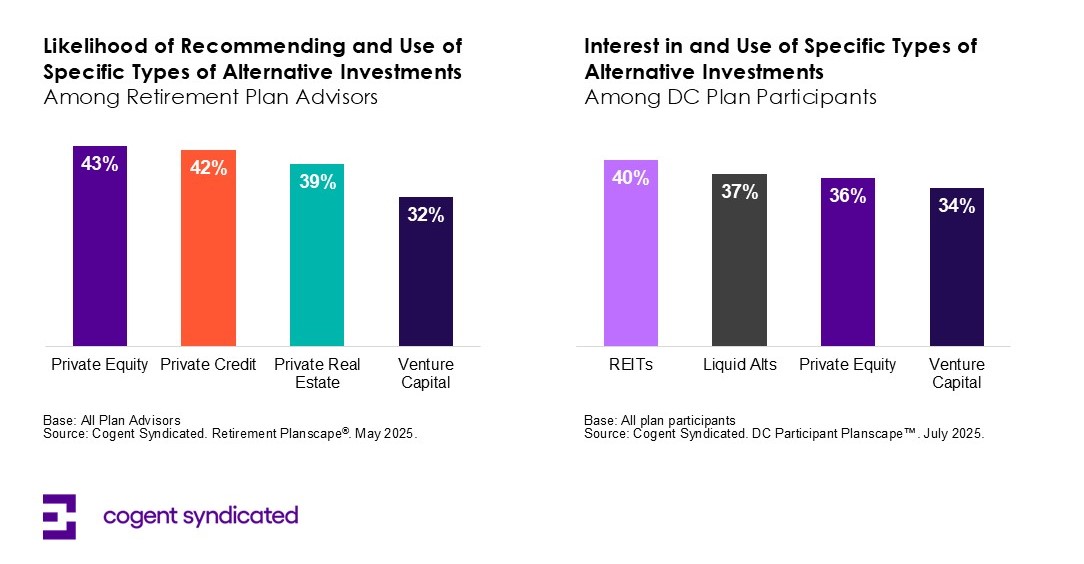

Among the various categories of alternative investments, advisors favored private equity, with 43% saying they already recommend it or are likely to do so. This was followed by private credit (42%), private real estate (39%), and venture capital (32%). These preferences broadly reflect findings from Escalent’s 2025 DC Participant Planscape™, released in July. When participants were asked which alternative investments they were already using or most interested in for ESRPs, real estate, private equity, and venture capital emerged as frontrunners. Participants ranked real estate investment trusts (REITs) highest at 40%, followed by liquid alternatives (37%), private equity (36%), and venture capital (34%).

While demand for alternatives is already high, continued category growth will depend on how effectively providers support the features and structures advisors value most. When asked what would influence them to start recommending alternatives or increase their current recommendations to plan sponsors, DC advisors cited lower fees (38%), client requests for inclusion (34%), and increased liquidity (33%). These findings are especially significant in light of data from DC Participant Planscape, which suggests advisors are likely to field more requests for alternative investment options moving forward.

“The DOL’s decision marked a turning point for the use of alternatives in workplace plans, and the market is still adjusting,” said Sonia Davis, senior product director in Escalent’s Cogent Syndicated division and lead author of both studies. “What stands out in our research is how closely advisor interest tracks with the growing curiosity we are seeing among plan participants. As such, we can expect DC advisors to seek out suitable options as client inquiries continue to expand. The firms that align their alternative offerings with advisors' priorities will be in the best position to capture that momentum.”

About Retirement Plan Advisor Trends™

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross section of 411 plan advisors from September 8 to September 19, 2025. Survey participants were required to have an active book of business of at least $5 million and be actively managing DC plans. Strict quotas were set during the data collection period, and post-fielding statistical weighting (where necessary) was applied. The data have a margin of error of ±4.83% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 2,000 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE, and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT

Alexia Garcia

616.893.2696

agarcia@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4a2e134d-5b72-4a86-a310-df5a90888457

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.